April 15, 2018

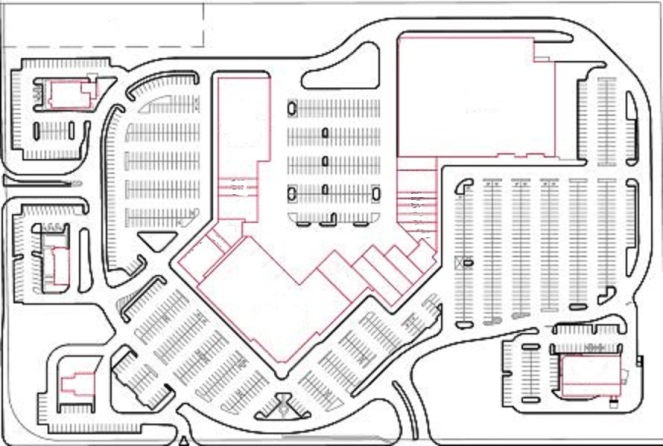

A few months back, we addressed what happens when you leave phantom square footage in the denominator. But, this week, we actually had a lease where the tenant requested (AND THE LANDLORD AGREED!) to add square footage to the denominator for purposes of allocating CAM and taxes.

First off, this was not a local developer that agreed to this language. Rather, it was a sophisticated, national developer with power and grocery anchored centers across the country. And, the tenant happened to be a fairly desirable big box.

The lease language stated that if any part of the common area was used for sales or storage, the square footage had to be included in the denominator for purposes of allocating CAM and taxes for the tenant (the big box tenant with this language).

What you should be aware of is that gross leasable area typically includes only enclosed, heated and cooled spaces used for retail sales or services. For example, think about a discount superstore. There is often an administrative office mezzanine area. Usually, that square footage would be excepted from the total GLA. However, we have grocery stores in our area where the mezzanines are used for demonstration kitchens and classes. That area is typically included. Similarly, walk into the garden center portion of a home improvement store and the portion not air conditioned is typically excluded.

However, in this case, if a tenant (including itself) was permitted to park a storage trailer out back for 2 months a year, the 640’ would have to be included in the denominator for this particular tenant. The lease did not even address including only the weighted average square footage (where we would do 640 sf x 2/12). If you have multiple tenants (or events, including sidewalk sales), you have to include that square footage. You can see, it adds up.

On the 30,000 sf tenant, that is $5,100 per year. Cap that, and it is nearly $100,000 in value on the center!!!

What does this mean in terms of dollars? Let’s take a center that is 200,000 sf, and the big box tenant with this language is 30,000 sf. If our total CAM and taxes for the center were $1,400,000, a tenant paying on typical gross leasable area would pay $7.00/sf. ($1,400,000/200,000 sf) However, if we have 5,000 sf of common areas used even temporarily for sales and storage, the rate per square foot would drop to $6.83/sf ($1,400,000/205,000 sf) – a difference of $.17/sf. On the 30,000 sf tenant, that is $5,100 per year. Cap that, and it is nearly $100,000 in value on the center!!!

What makes it even more offensive is that a trailer or temporary selling space would not be considered when assessing the center (so there would be no increase in taxes) and in almost every instance, the tenant granted temporary use of the space is responsible for all expenses related to its use – so no increase in CAM.

Can I put a cherry on top of this? Yes, I can!!! If the big box tenant was the only tenant to have made use of that 5,000 sf, the lease only included the space in the denominator, not the numerator!!! That means, the more usage of the common areas this particular big box tenant uses, the less they pay!!!

Hopefully, we won’t see this language too often. But, when one landlord agrees to a clause, no matter how crazy, tenants get emboldened and present that language with another landlord as a precedent.

If you are ever unsure how to consider the impact of a requested change, feel free to comment, and I will try to give you the pros and cons of the language.

Comments |

Posted in Malls, Retail Leases, Shopping Center, Uncategorized