A need for a holistic approach to leases

September 23, 2018

When coming up with a blog topic for the week, I typically reflect back on one issue that stood out for the week. My guess is that it almost appears as if each of the issues are stand alone. But, this is never the case. Within one lease, you can have hundreds of potential changes, and then multiply that by the number of tenants in a property, and the combinations are exponential.

However, there are certain types of lease related issues that you truly only expect to see once every 5/10/15 properties. But, this week, we had a “perfect storm” – one property that had so many of these one off type issues.

This was a power center with two smaller specialty centers actually incorporated into the center, giving almost the feel of a lifestyle center. When the property was originally developed, the parcel for one of the two specialty centers was sold off and developed by another owner. They did a beautiful job on this 40,000 sf portion of the entire development. One of the big issues was that there is not an REA/OEA for the entire development. Therefore, the restrictions that apply to the balance of the center – exclusives, prohibited use, signage, height – do not apply to that center. Which makes the opposite true as well. Any time a property is going to be operated as one integrated center, there really needs to be an overall declaration.

One tenant at the center had co-participation language. They were only required to pay taxes if 90% of the other tenants were similarly obligated. You might imagine that we immediately had to focus on that particular lease’s definition of the shopping center. It was an “as reflected on Exhibit A,” with the Exhibit reflecting the entire development, including the separately developed center which the master landlord had absolutely no control over.

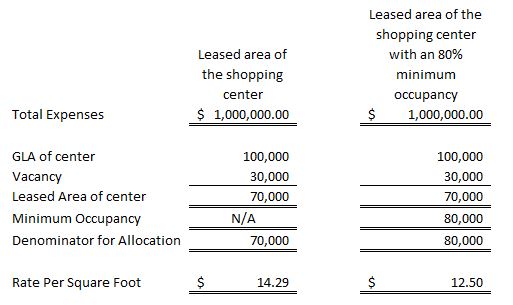

Then, there were two absolute minimum denominators. We had talked about this over the last couple of weeks. The denominator for prorata shares could never be less than xxx,xxx sf. However, a few portions of the development, including the separate center, were separately maintained. And, a few more parts of the center were being sold off (to realize some immediate value).

These were just a few of those big ticket lease clauses (or documents in the case of the Declaration) that exist at this particular property. While it is very easy to focus on the particular lease that you are working on/negotiating at the moment, it is critical that we take a holistic approach – looking at the property (and even in some cases, the entire portfolio) as a whole.

Why might it go beyond the property? It is a great topic for another week. However, one really quick example. Another client put a small grocery anchored center under contract this week. What makes this small acquisition unique is that it is immediately adjacent to another of their own centers. The first item we tackled was not a lease on the new acquisition, but the list of restrictions and exclusives on the existing center, and whether there might be landlord radius restrictions. (While radius restrictions exclude “then-existing” more often than not, there are those that are the exception.)

Bottom line, there are consequences/impacts to every change made to a lease – often going beyond that single landlord/tenant relationship.