Minimum occupancies

September 2, 2018

When a tenant’s prorata share is based upon the leased area of a shopping center (rather than leasable), a very common change to the lease language negotiated by tenants is the addition of a minimum occupancy. The language would read something to the effect of:

“The tenant’s prorate share of CAM shall be based upon the leasable area of the premises over the leased area of the shopping center (with the addition of) however, in no event shall the denominator be less than 80% of the leasable area of the shopping center.”

Using the “leased” area of the shopping center, the landlord reduces the absorption it would otherwise experience due to vacancy. The purpose of the tenant’s added language is protect itself from the vacancy getting too high, causing its rate per square foot to get much higher.

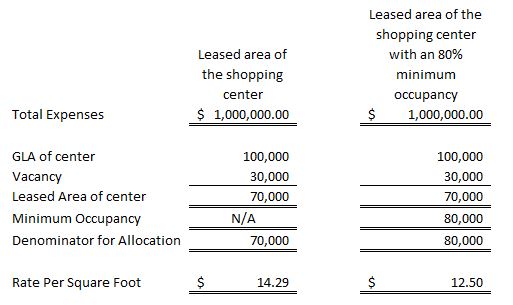

A nice, simple example of the minimum occupancy in action would be a 100,000 square foot shopping center with 30,000 sf of vacancies where total reimbursable expenses for the center are $1,000,000:

As you can see, by negotiating this clause, the tenant was able to reduce its expense by $1.79/sf. If vacancy had increased to 50,000 of the 100,000, without a minimum occupancy, the rate would increase to $20.00/sf, but with the 80% minimum occupancy, the rate would still be $12.50/sf.

If all of the tenant is the center were billed based upon the “leasable” area of the center, the rate per square foot in this case would be $10.00/sf ($1,000,000/100,000 sf). With 30,000 sf of vacancy, the landlord would then “absorb” $300,000 due to vacancies (30,000 sf x $10.00sf). However, if all of the tenants were paying based upon “leased,” the tenants would pay 70,000 sf x $14.29/sf = $1,000,000. Therefore, the landlord would have no absorption. But the minimum occupancy holds the landlord accountable for excess vacancy.

That was a simple example. It gets a bit more complicated when there are excluded areas defined. The minimum occupancies are typically calculated after deducting the excluded areas. For example, if there was a 25,000 sf tenant in our example center and that tenant was defined as an excluded area, we would calculate the minimum occupancy on 100,000 sf less 25,000, or 75,000 sf. In that case, actually “leased” area would be 100,000 sf – 25,000 sf (major) – 30,000 sf vacancy = 45,000 sf denominator. But with the minimum occupancy, we would compare the 45,000 sf to a 60,000 sf minimum denominator (75,000 x 80%). (In the case of the excluded area, we would also typically deduct the contribution from the excluded area).

Next week, I will give one more example – where there is an “absolute” minimum denominator. It’s a bit more complicated, and causes a few other considerations.