“We see the retail business is getting busy again”

March 19, 2020

Not my typical lease administration post. Just sharing an email that I received this morning.

Personally, when I have to do something I don’t want to. I tell myself, “There is nothing I can’t do for X amount of time.” X amount of time has always been a wide variable – in some cases, it could be seconds, minutes or hours while in others, it has been days, weeks or months. I tell myself I can get through it because there is an end in sight.

Like so many of us, my own level of anxiety has been driven quite a bit higher over the last couple of weeks. I realized when I received an email this morning, it was because I couldn’t see an end.

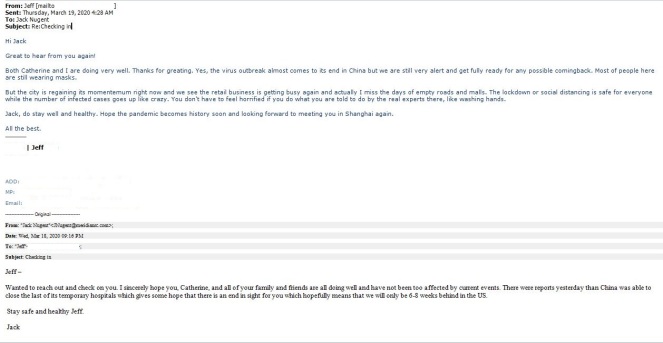

I have stayed in touch with some of the wonderful people I met in Shanghai while teaching classes for ICSC. Selfishly, I hadn’t thought to reach out while they were in the early stages of it. But I did this week and this is the response I received this morning:

Hi Jack

Great to hear from you again!

Both Catherine and I are doing very well. Thanks for greating. Yes, the virus outbreak almost comes to its end in China but we are still very alert and get fully ready for any possible comingback. Most of people here are still wearing masks.

But the city is regaining its momentemum right now and we see the retail business is getting busy again and actually I miss the days of empty roads and malls. The lockdown or social distancing is safe for everyone while the number of infected cases goes up like crazy. You don’t have to feel horrified if you do what you are told to do by the real experts there, like washing hands.

Jack, do stay well and healthy. Hope the pandemic becomes history soon and looking forward to meeting you in Shanghai again.

All the best.

This simple email has shown me there is an end. While I may not know what the X amount of time is in this case, there is some X. I can get through this. WE can get through this.

Remember at the end of It’s a Wonderful Life, when George comes bursting through doors and runs through the house like a mad man. At that moment, he truly appreciates the finial on the stairs that he had never fixed and had been a troublesome thorn in his side.

While we may not know exactly when, that email from Jeff in Shanghai has given me both hope and a new found appreciation for my broken finials.