Leased vs. Leased and Occupied

March 4, 2018

A few months ago, we had a blog that addressed a difference in lease language where an excluded area was defined as any premises greater than 15,000 sf vs any occupant greater than 15,000 sf – a subtle change in lease language having a material impact on a lease’s or even a property’s cash flow.

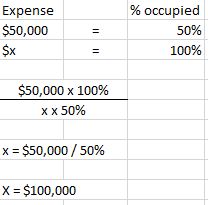

This week, we had a similar situation related to different wording. The expenses of the property were to be “grossed up” to what they would be if the property were 95% occupied. This gross up language is most commonly associated with office leases where a tenant’s prorate share is determined using the rentable area of the building. If the building has 100,000 sf and the tenant is 10,000 sf, their prorata share is 10%. That 10% may even be fixed in the lease. If the building was only 50% occupied, and janitorial in the office building was $50,000, without a gross up, the tenant would pay $50,000 x 10% = $5,000. However, a gross up recognizes that the $50,000 in expenses were attributable to a half full building. To keep it simple, if we “grossed up” expenses to what they might be if the building were 100% occupied, we would essentially calculate:

So, using the grossed up share of $100,000 x 10%, the tenant’s share of the expense would be $10,000. So, if the 50,000 sf of occupied tenants all paid using the grossed up expenses, they would pay a total of $50,000, and the landlord would be whole. If the expenses were not grossed up, the tenants would have only paid $25,000, with the landlord absorbing the other $25,000 in expenses. (This example used straight prorate. In office, tenant’s shares are often couple wit base years as well, but I was trying to keep the example straightforward).

Simply, the purpose of the gross up is to make sure the tenants are paying their share of variable expenses based upon the square footage of the property occupied, really the square footage causing that expense. (Notice, only variable expenses get grossed up. If landscaping cost $25,000 per year, that expense would likely not vary if the property was 50% or 100% occupied so would not get grossed up.)

This week’s issue that caused some debate was the wording of an inline tenant’s lease in a retail property. As discussed, gross ups are typically associated with office leases. Therefore, office landlords are pretty detailed with the gross up language – they know what is needed. The tenant’s lease required the tenant to pay a prorata share of expenses based upon its square footage over the square footage of the center (there were some issues as to whether outparcels were included or excluded from the definition of the center, but that’s another story!). The expenses were also to have been grossed up to what the expenses would have been if the center had been 95% leased.

As the examples show, the purpose of a gross up is to determine what the expenses would have been had the center be 95% occupied. But, that’s not what the lease said. It said 95% leased. Subtleties! Subtleties!

In the property, there is a 25,000 sf premises which had been vacant for a number of years. In mid 2016, a lease was executed for that particular premises. The tenant took possession of that premises on the day the lease was executed. Because some approvals were needed from other tenants, the tenant received permits in March 2017. The rent commencement dated was the earlier of open or permits + 180 days. As of March 2018, the tenant is still not open.

Based upon the “intent” of a gross up clause, we would treat the premises as un-occupied, and we would still be grossing up. However, based upon the terms of that particular lease, the Commencement Date of that lease was possession – mid 2016. Therefore, as of mid 2016, that particular premises was actually leased.

Two words often used interchangeably – occupied and leased – making a difference as to whether we have the ability to gross up expenses. The intent was clearly to gross up if the center was less than 95% occupied, but we are stuck with the word “leased.” The premises was, in fact, leased.

Pay attention to the language!